Getting a job offer feels great, but the real work starts the moment it hits your inbox. It’s easy to get fixated on the salary, but that single number rarely tells the whole story of what your life and career will look like for the next few years. A truly great offer is a balanced package.

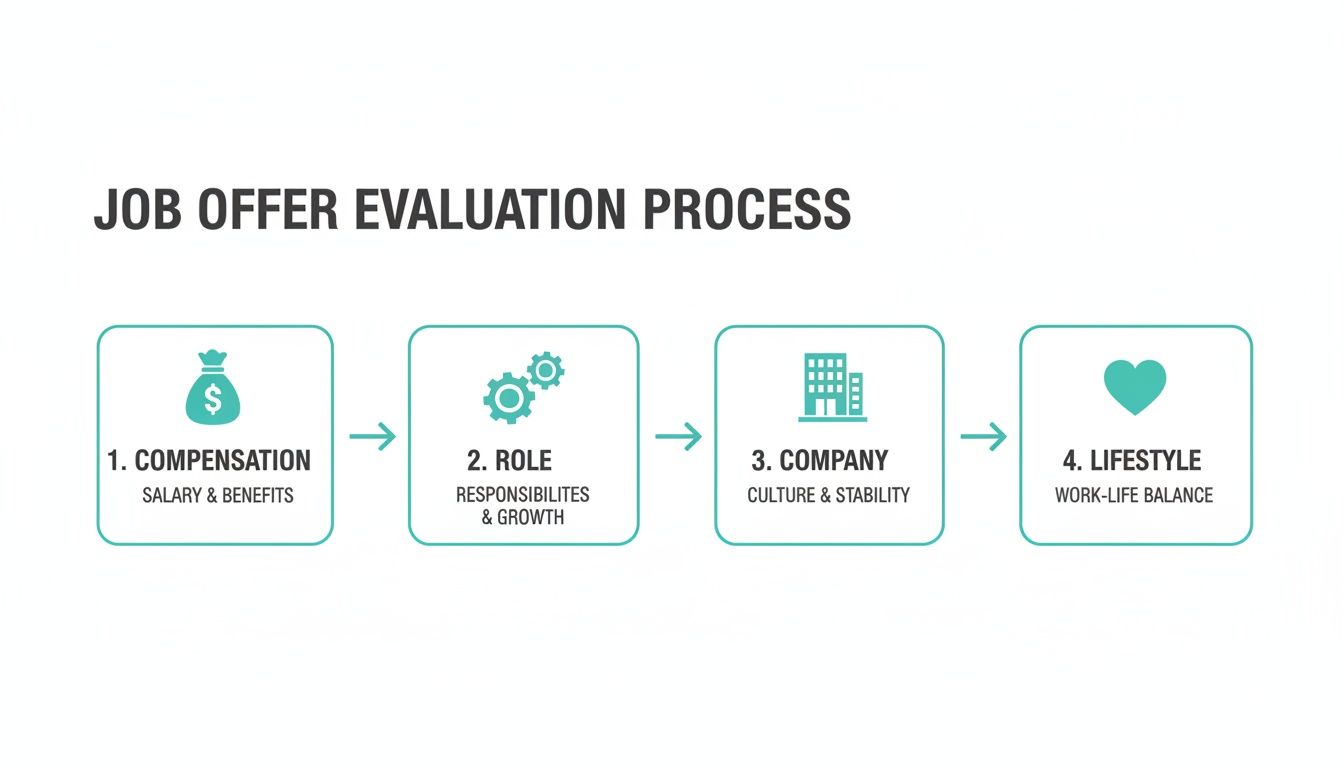

To make the right call, you need to look at the four key pillars: the complete compensation picture (salary, bonus, and that all-important equity), the role itself and where it can take you, the company's stability and culture, and finally, the benefits and lifestyle factors that shape your day-to-day. Thinking through these four areas is the difference between just taking a bigger paycheck and making a smart, strategic career move.

This guide gives you a practical framework for dissecting any tech offer, especially from startups where things like equity, runway, and culture carry so much more weight. We'll break down the entire process so you can compare opportunities with confidence and clarity, moving past the headline number to what a role is really worth.

Making an informed decision is more critical now than ever. The tech industry is in a state of recalibration, leading to a much more selective hiring environment. Companies are being more cautious, and candidates need to be more diligent.

For example, recent data shows a widening skills gap. One 2025 technology recruitment report noted that filled tech jobs dropped by 84% in a single quarter, even as job postings stayed steady. In that same period, average salaries for some roles even dipped by 8.5%. This isn't to scare you—it's to highlight that you need to evaluate offers with a sharp, critical eye.

A job offer is more than a salary; it's a complex package of financial rewards, career opportunities, and personal trade-offs. Your goal is to decode its total value, not just its immediate cash value.

To make a well-rounded decision, you need to analyze an offer through four distinct lenses. Each one reveals a different part of the overall picture. We'll touch on them here and then dive much deeper into each one.

To help you keep track of these moving parts, here's a quick checklist you can use as we go through the guide.

Use this checklist to systematically analyze and compare the core components of any tech job offer you receive.

This table serves as our roadmap. In the following sections, we'll break down each category in detail, giving you the tools and questions you need to make the best possible decision.

When an offer lands in your inbox, your eyes naturally jump to the base salary. It's the simplest number on the page, but in the tech world, it’s rarely the whole story. To really know what an offer is worth, you have to think in terms of total compensation.

This mindset is crucial. It stops you from getting dazzled by a big salary that might be hiding weak equity or a non-existent bonus. Looking at the complete picture forces you to model what you could earn over several years, not just on your next paycheck. It's the only way to fairly compare an offer from a stable FAANG company with one from a high-growth, high-risk startup.

This evaluation process isn't just about the money, though. It's a holistic check across four key areas: compensation, the role itself, the company's health, and your personal lifestyle.

As the graphic shows, compensation is where you start, but it's deeply connected to everything else. A massive compensation package for a role you’d hate at a company with a toxic culture isn't a win.

Equity is easily the most confusing—and potentially most valuable—part of a startup offer. This is your slice of the pie, your ownership stake in the company. It's the primary way early employees get to share in a massive success. You'll almost always see it in one of two forms: Stock Options or Restricted Stock Units (RSUs).

Generally, early-stage startups lean toward ISOs, while more mature, pre-IPO companies and public corporations prefer RSUs since their stock already has a clear market value.

If this is new territory, take the time to really understand the mechanics. Our guide on startup equity basics for job seekers is a great place to start.

For a quick breakdown, here’s how the two most common equity types stack up.

Understanding the nuances between ISOs and RSUs is key to projecting your potential earnings and risks. While both represent ownership, they function very differently, especially when it comes to taxes and upfront costs.

This table highlights the fundamental trade-off: ISOs offer potentially greater tax advantages but come with the real risk of costing you money to exercise. RSUs are simpler and safer, but the tax hit at vesting is immediate and unavoidable.

Your offer letter will proudly state the number of options or RSUs you’re getting, but that number on its own is just vanity. To figure out what it’s actually worth, you need to ask for two more data points:

Let's run through a real-world example. A Series A startup offers you 20,000 ISOs.

First, let's figure out your ownership percentage: (20,000 options / 10,000,000 total shares) = 0.2% of the company.

Next, what's the "paper value" of that grant right now? You calculate the spread between the current value and your cost: 20,000 options × ($2.00 current value − $0.50 strike price) = $30,000.

That’s the potential pre-tax profit if you could magically sell your shares today. But you can't. The real game is betting on future growth. If this company takes off and its valuation doubles, that $2.00 share price might jump to $4.00. Suddenly, your grant is worth $70,000. That's the upside you're signing up for.

Remember: Equity is not guaranteed money. It's a high-risk, high-reward lottery ticket. Its value is effectively zero until the company has a "liquidity event"—like an acquisition or an IPO—that allows you to actually sell your shares.

While equity holds the promise of a life-changing payout, don't sleep on the cash components of your offer. They provide the financial stability and predictability you need while you wait for that equity to mature.

Signing Bonus

This is a one-time cash bonus you get for joining. Companies often use this to make an offer more attractive without bumping up the base salary permanently. It's also a common tool to compensate you for a bonus you're walking away from at your current job. Don't be shy; this is almost always negotiable.

Performance Bonus

This is an annual bonus tied to how well you and the company perform. You need to ask two things: What is the target percentage (e.g., 15% of base salary)? And how consistently has the company actually paid it out in recent years? A "target" is just that—a target. It's not a promise.

Equity Refreshers

These are additional equity grants you receive each year to keep you motivated and aligned with the company's long-term success. For long-term wealth creation, refreshers are absolutely critical. Ask if the company has a formal refresher program and what a typical grant looks like for someone at your level.

To get the clearest comparison between offers, you have to model your total compensation over a four-year period—the standard vesting schedule for a new hire equity grant. An offer with a lower base salary but strong annual refreshers could easily eclipse a higher-paying job over that timeframe, assuming the startup executes well. Your job is to weigh that potential against the risk.

An amazing compensation package means nothing if you're miserable day-to-day. A fat salary and a mountain of stock options can lose their shine fast when you're stuck in a dead-end role, fighting with a toxic team, or working for a company that’s quietly circling the drain.

The numbers on the page are just one part of the story. The real impact on your career and happiness comes from the qualitative stuff—the signals you pick up about the role, the team you’ll be joining, and the overall health of the business. This is about making sure the work is actually what you want to be doing in an environment that will help you grow, not burn you out.

First things first: you have to get a crystal-clear picture of what you'll actually be doing. Job descriptions are notoriously vague. Your mission is to cut through the fluff and understand the real scope, autonomy, and impact of the position.

Ask your future manager what success looks like in the first six months. Getting a concrete answer helps you figure out if this is a genuine step up or just a lateral move that won’t teach you anything new.

Here are a few actionable questions to ask your potential manager:

These aren't generic questions. They force specific, real-world answers that reveal the truth about the role and where it can take you.

The people you spend 40+ hours a week with will make or break your job experience. It doesn't matter how cool the role is; if the team is dysfunctional, you're heading straight for burnout. You're not just joining a company—you're embedding yourself into a tiny subculture with its own weird norms and communication quirks.

For engineers, designers, or PMs, the product and engineering culture is everything. This covers how they ship code, handle technical debt, run design reviews, and settle disagreements. A healthy culture feels psychologically safe, encourages people to learn, and actually respects your time outside of work.

Your future team’s culture is the invisible force that will either amplify your skills or drain your motivation. Pay close attention to how they collaborate, handle conflict, and support each other's growth.

Get a feel for the team by asking practical questions that reveal how they really operate.

The answers—and how they answer—will tell you volumes about their maturity, how they collaborate, and whether they follow best practices or just wing it.

This is non-negotiable, especially at a startup: you must do your homework on the company's financial health. Your equity is just a piece of paper if the company goes under. You need to investigate its financial stability, where it sits in the market, and the quality of its leadership.

Start with the basics: funding and runway. Runway is just the amount of time the company has until the cash runs out. You're looking for a healthy 18-24 months of runway. Anything less than a year is a potential red flag that could signal instability or layoffs are on the horizon. Ask the recruiter or hiring manager directly: "What is the company's current runway?"

Next, look at who invested. Are they top-tier VCs with a history of backing winners? Big-name investors are a strong vote of confidence in the company's long-term vision.

Finally, remember the power you have in today's market. Candidates are asking tougher questions, and companies know they have to answer. While offer acceptance rates are climbing, a significant 17% of U.S. offers are still rejected for reasons that have nothing to do with salary. Data shows that nearly half of tech candidates will walk away from roles that don't offer remote work, and 67% expect full transparency on pay.

This market gives you the leverage to dig deep. For more on what candidates are demanding, check out the 2025 recruiting benchmarks report.

By putting the role, team, and company under a microscope, you build a complete picture that goes way beyond the numbers. That balanced view is the only way to make a smart decision that pays off for your bank account and your career.

Once you get past the big numbers on salary and equity, you hit what I think is the most underrated part of any job offer: the benefits and lifestyle package. It’s easy to get fixated on the cash, but these perks are the foundation of your financial health and day-to-day happiness. They shape how this new job will actually fit into your life.

Frankly, an offer with a slightly lower salary but incredible benefits can often be the smarter move in the long run. A huge part of this is figuring out how you’ll balance life and work with the new role’s demands. This goes way beyond just counting vacation days; it’s about the entire support system the company offers.

Health insurance and retirement plans are notoriously complicated, but they represent thousands of dollars in hidden compensation. You absolutely have to dig into the details to understand their real value.

Let's start with healthcare. The plan type is the first big fork in the road.

But don't stop at the plan type. You need to check the deductible—that's the amount you have to pay yourself before your insurance starts covering anything. A plan with a low monthly premium but a $5,000 deductible could be a much worse deal than one with slightly higher premiums and a $1,000 deductible, especially if you expect to need some medical care.

A strong 401(k) match is one of the easiest ways to build wealth. A 100% match on the first 4-6% of your salary is essentially a guaranteed 100% return on your investment—free money you shouldn't ignore.

Next up is the 401(k) or retirement plan. The magic number here is the employer match. If a company offers a "dollar-for-dollar match up to 5%," that means if you contribute 5% of your salary, they'll put in another 5% for free. This is a massive, immediate boost to your retirement savings.

Lifestyle benefits are all the things that impact your work-life harmony and professional growth. They don't always have a clear dollar sign attached, but their impact can be immense. You have to assign your own value to them based on what truly matters to you.

I find it helpful to create a simple scorecard to compare offers side-by-side.

For someone who craves flexibility or plans to start a family, Company A’s generous parental leave and fully remote policy might be worth tens of thousands of dollars when you factor in saved commuting costs and childcare flexibility. But for someone laser-focused on upskilling, Company B's limited professional development stipend could be a major red flag.

This scorecard forces you to put a number on what you value. The "best" benefits package isn't universal; it's the one that best supports your personal and professional life. By breaking it down like this, you ensure your next role is a fit for your well-being, not just your wallet.

You’ve navigated the interviews, crunched the numbers, and assessed the culture. Now for the final hurdle: negotiating the offer so it genuinely reflects your worth. This isn’t about drawing a line in the sand; think of it as a professional conversation to find a sweet spot that works for both you and your future employer.

This is the moment your leverage as a sought-after candidate really comes into play. Just getting an offer is a huge win in itself. The tech market is notoriously selective—recent data shows only 7% of technical candidates who interview actually receive an offer. That number should tell you just how much a company wants you when they slide that letter across the table. You can dig into more of these hiring dynamics in Ashby's 2023 Talent Trends report.

Walking into a negotiation armed with data is the difference between making a request and building a case. The goal is to anchor the conversation in market reality, not just what you feel you should be paid. This approach strips out the emotion and frames you as a prepared, thoughtful professional.

Before you even think about picking up the phone, do your homework. Dive into resources like Levels.fyi, Glassdoor, and other industry salary surveys to find benchmarks for your specific role, experience level, and city.

When it's time to make your counter, lead with that research.

For example, you could say:

"Thank you so much for the offer; I'm incredibly excited about the opportunity to join the team. Based on my research for a Senior Product Manager role in San Francisco with my level of experience, the market rate for total compensation is closer to the $220k-$240k range. Given my specific expertise in B2B SaaS migration, I'd be more comfortable if we could get closer to that."

This is a powerful, non-confrontational way to kick things off. You’ve shown enthusiasm, presented a data-backed range, and tied it directly to the unique value you're bringing.

Market data gets you in the door, but you need to be crystal clear about why you are worth the extra investment. The company is already sold on you—that's why they made an offer. Your job now is to remind them of the specific skills and experiences that make you an exceptional hire.

Connect your points back to the problems they told you about during the interviews. Did they mention their struggles with scaling their infrastructure? Remind them about that successful scaling project you spearheaded at your last gig.

When you frame it this way, you’re not just asking for more money; you’re justifying their increased investment in you. For a deeper look at building your case, our guide on how to counter a job offer has more scripts and tactics.

Negotiation is a dialogue, not a demand. Approach it with a collaborative spirit, aiming for a win-win outcome where both you and the company feel great about the final agreement.

Once you have a verbal "yes," you're almost at the finish line, but don't pop the champagne just yet. A few final moves will ensure everything ends smoothly, whether you take this offer or decide to move on.

1. Get Everything in Writing

Never, ever resign from your current job based on a handshake or a verbal agreement. Politely ask for an updated, official offer letter that spells out every term you’ve negotiated—base salary, signing bonus, equity grant, start date, and any other perks. Read it over carefully to make sure every single detail is correct.

2. Formally Accept the Offer

Once you’ve confirmed the written offer is accurate, send a clear and enthusiastic acceptance email. This is a great chance to restate how excited you are to join the team and confirm your start date.

3. Gracefully Decline Other Opportunities

If you have other offers in your back pocket, it’s critical to decline them professionally. The tech world is small, and you never know when your paths might cross again. Send a courteous email to the recruiter or hiring manager, thanking them for their time but explaining that you've accepted a role that's a better fit for your career goals right now. It keeps the relationship positive and leaves the door open for the future.

Even with a solid framework, you're bound to hit specific situations that feel tricky. Some questions pop up again and again, especially when you’re wrestling with the unique risks and rewards that come with the startup world.

Let's break down some of the most common dilemmas you might face.

When you’re looking at an offer from a pre-revenue, early-stage company, your mindset has to shift from looking at current stability to betting on future potential. The usual metrics just don't apply here. Instead, you need to dig into the fundamental ingredients for success.

Your first line of investigation should be the founding team’s experience. Have they done this before? What’s their track record? You're essentially placing a bet on their ability to execute, so do your homework. Strong signals also include the size of their target market and the quality of their early investors—getting backing from top-tier VCs is a major vote of confidence.

Since you're taking on immense risk, your equity grant needs to be substantial to make it worthwhile. Don't be shy about asking direct questions about their financial runway and their concrete plans for the next funding round. You need to know how many months of cash they have in the bank.

It can be, but this is a big "it depends." This move is highly dependent on your personal risk tolerance and requires a strong, well-researched belief in the company's growth trajectory.

Trading cash today for equity tomorrow only makes sense if you’re confident the company's valuation will increase significantly. That's the only way your stock will become worth far more than the salary you gave up. This is usually a more calculated risk at a Series A or B company that has already found product-market fit and is starting to scale.

Before you even consider it, model a few potential exit scenarios. Figure out what your equity stake could be worth if the company has a 2x, 5x, or 10x increase in valuation down the line.

An exploding offer—one that gives you less than 48 hours to decide—is a major red flag. A company that respects your decision-making process will give you adequate time to evaluate such a critical life choice.

Certain signals should give you serious pause during the offer stage. Besides the exploding offer mentioned above, a lack of transparency around equity is a huge one. If a company is cagey about sharing the total number of outstanding shares, you can't calculate your actual ownership percentage. It’s a sign they might be hiding something.

Other red flags to watch out for include:

Ultimately, trust your gut. If the hiring process felt disorganized, rushed, or disrespectful, the job itself will likely feel the same way. For more guidance, running through a list of smart questions to ask before accepting a job can reveal a lot about a company's true colors.

While salary is key, a comprehensive evaluation should include the total compensation package (bonus, equity, benefits), long-term career growth and learning opportunities, company culture and team dynamics, work-life balance and flexibility, and the role's alignment with your personal values and professional goals. The best offer balances immediate reward with future potential.

Don't just look at the number of shares. Ask for the percentage of the company it represents and the latest fair market value (409A valuation) to understand its current worth. Understand the vesting schedule (typically 4 years) and the exercise window if you leave. Consider the company's funding stage and growth potential, but remember equity is a high-risk, high-reward component.

Move beyond generic questions. Ask about meeting norms, decision-making processes (top-down vs. collaborative), and how success is measured. Inquire about team turnover, how feedback is given, and what happens when projects fail. Observing how interviewers interact and answer these questions can be very revealing.

Benefits can add significant value. Key things to evaluate include health insurance quality and cost, retirement plan matching, paid time off policies, parental leave, and any unique perks like learning stipends or wellness budgets. Calculate the monetary value of these benefits to understand the true total compensation.

Ask about typical career paths for the role, the frequency and process of performance reviews, budgets for conferences or courses, and whether the company supports internal mobility. Look for signs of investment in employee growth, such as mentorship programs or a history of promoting from within.

Negotiation is almost always expected. If any part of the offer doesn't meet your market value or needs, it's appropriate to negotiate respectfully. Use data to support your request. You should feel comfortable accepting if the offer meets your minimum requirements, aligns with your career goals, and the company has addressed all your questions satisfactorily.

Most companies expect a decision within a few days to a week. It's professional to acknowledge receipt of the written offer immediately and give a specific date by which you will respond. If you need more time because you are waiting on another offer, communicate this transparently to see if they can extend the deadline.

Ready to find a tech job offer worth evaluating? Underdog.io connects top tech talent with curated opportunities at high-growth startups and tech firms. Skip the endless applications and let the best roles come to you. Create your free profile at https://underdog.io.