Before you even think about negotiating your stock options, you need to speak the language. Your offer letter is going to be packed with terms like vesting, cliffs, and strike price, and figuring out what they actually mean is the first, most critical step. Get this right, and you'll be in a much stronger position to advocate for a package that truly reflects your value.

Let's be real—a startup offer filled with equity jargon can feel like reading a different language. Terms like "ISOs" and "fully diluted shares" are thrown around, often with little explanation, leaving you to guess their real-world impact.

Think of your equity grant as a locked treasure chest. Understanding each term is like finding the right key; each one plays a specific role in determining when and how you can access that potential value.

First things first, let's break down the essential terms you'll see on almost every offer. These aren't just technical details; they are the fundamental levers that control your potential wealth.

Here’s a quick rundown of the must-know terms you'll encounter.

Getting comfortable with these terms is your first homework assignment. They form the foundation of any equity conversation you'll have.

The vesting schedule is the timeline for earning your shares. It’s the company's way of making sure you're committed for the long haul.

Actionable Insight: By far, the most common structure you'll see is a four-year vesting schedule with a one-year cliff. This means you get absolutely nothing until you hit your first work anniversary. After that, you typically start vesting a portion of your remaining shares every single month.

That one-year cliff is a huge milestone. If you leave the company for any reason before that first anniversary, you walk away with zero vested options. It's a tough but standard practice.

Finally, there's dilution. As a startup grows and raises more money from investors, it has to issue new shares. This means your slice of the pie gets a little bit smaller. It's a natural part of a startup's lifecycle, but it's important to be aware of how it impacts your potential upside.

To really get a handle on how these pieces fit together, check out this excellent beginner's guide on How Stock Options Work: A Beginner's Essential Guide. You can also dive deeper with our own guide to startup equity basics for job seekers. Knowing this stuff is non-negotiable for assessing what your grant is worth today and what it could be worth in the future.

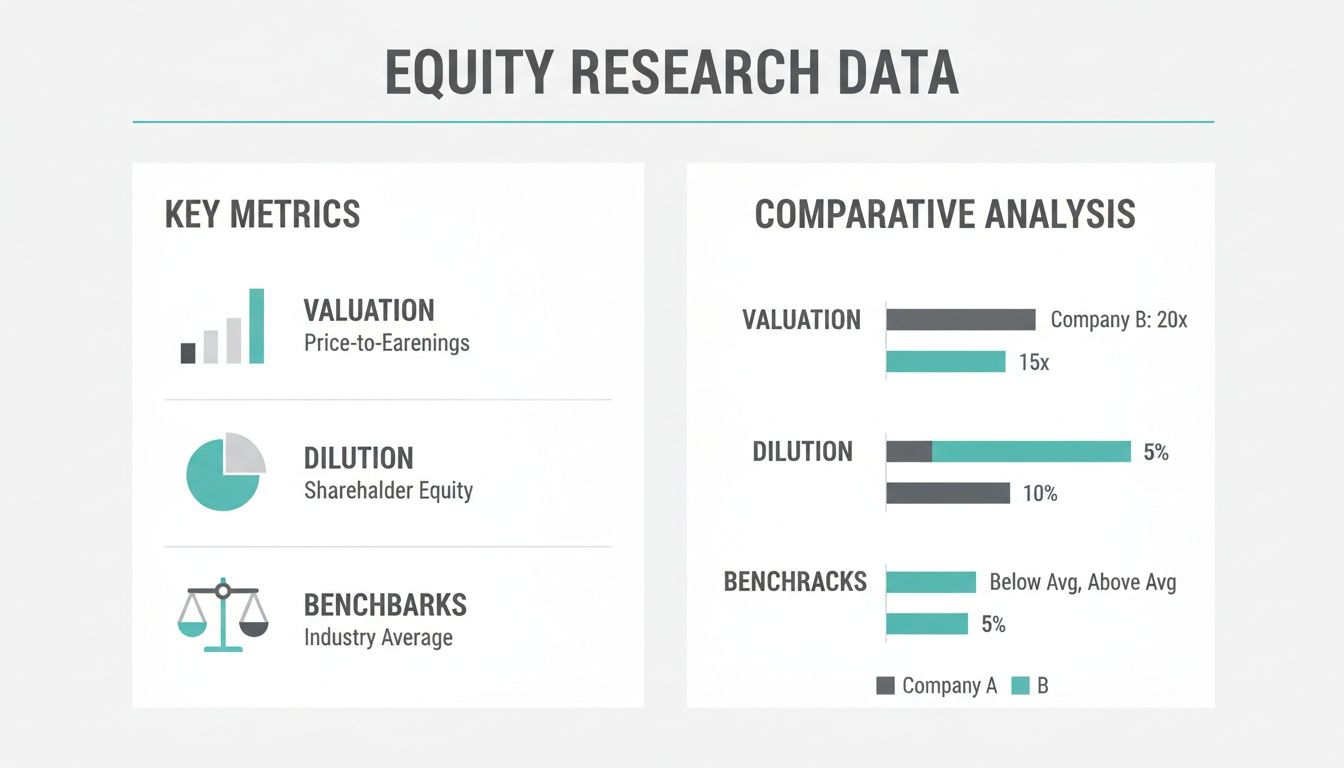

A strong negotiation is built on solid data, not just feelings. Before you even think about putting together a counteroffer, you have to do your homework. This is your pre-negotiation bootcamp, where you'll learn exactly how to size up an offer so you can walk into that conversation with the confidence and context to back up your position.

The idea here is to completely reframe the conversation. You want to shift it from a simple, "I want more," to a much more powerful, "Here's what the market data suggests for a role like this at a company of your stage." It's a professional, data-driven approach that's way more effective.

Your research needs to hit two key areas: company health and compensation benchmarks. One tells you about the potential upside of the equity, while the other tells you if your specific slice of that pie is actually fair.

First, you'll want to dig into the company's vital signs. You need a clear picture of its trajectory to really gauge the risk-versus-reward of its stock options.

Once you have a handle on the company's health, it's time to figure out what a competitive offer actually looks like. This is where you move from gut feelings to objective facts.

Actionable Insight: The single biggest mistake candidates make is failing to benchmark their offer. Without market data, you're negotiating in the dark, and you're far more likely to leave a significant amount of value on the table.

Platforms like Levels.fyi and Wellfound (formerly AngelList) are indispensable here. They offer crowdsourced compensation data, breaking down salary and equity grants by role, level, company stage, and location.

For instance, if you're looking at a Senior Software Engineer role at a Series A startup in San Francisco, you might discover the typical equity grant falls somewhere between 0.15% to 0.25%. If your offer comes in at 0.08%, you now have a concrete, data-backed reason to ask for more. This is a game-changer for negotiating your stock options.

The raw number of options in your offer letter is almost meaningless without more context. To truly understand its value, you need one crucial piece of information: the total number of fully diluted outstanding shares.

Don't be shy. Ask your recruiter or hiring manager this question directly: "To help me evaluate the full compensation package, could you please share the total number of fully diluted shares outstanding?"

Their willingness to share this is a pretty good indicator of their transparency. A flat-out refusal is a bit of a red flag. Once you have this number, you can do some simple math to find your real ownership percentage:

(Number of Options Offered / Total Fully Diluted Shares) * 100 = Your Ownership Percentage

This percentage is the number you'll use to compare your offer against the benchmarks you just found. It's an absolutely essential step for anyone trying to navigate the world of early-stage startup jobs.

History shows that early employees who pushed for better terms often saw massive returns. Take Uber, for example. Initial employees received options with strike prices as low as $0.50 when the company was valued at less than $100 million. By its 2019 IPO, those who had negotiated larger grants—often aiming for 0.5-1% for the first 10 hires—realized gains that exceeded 9,000%. Citing relevant benchmarks like these can completely flip the dynamic of a negotiation.

An offer of 20,000 options is just a number until you can attach a potential dollar value to it. This is where you need to get your hands dirty and turn abstract figures into tangible financial scenarios. The whole point is to figure out if the equity being offered truly makes up for the risk you're taking by joining a startup.

Before you can even think about negotiating your equity, you have to understand what it could realistically be worth down the line. It's time to move beyond the simple ownership percentage and put a dollar figure on your grant. Don't worry, you don't need a complex financial model—at least not to start. Some simple, back-of-the-envelope math will do the trick.

The most straightforward way to get a baseline value for your grant is to use the company's last known valuation, which usually comes from its most recent funding round. This is often based on the 409A valuation, or fair market value (FMV). You should be able to get this information from the founder or hiring manager. If they're cagey about it, that's a red flag.

Let’s walk through a quick example:

First, figure out the price per share from that last round:

$25,000,000 / 10,000,000 shares = $2.50 per share

Now, you can calculate the current estimated value of your grant:

20,000 options * $2.50 per share = $50,000

This $50,000 is the current "paper value" of your entire grant, often presented as being worth $12,500 per year over four years. This is your baseline for evaluation.

A startup’s value can—and hopefully will—change dramatically. That single valuation from the last funding round doesn't tell the whole story, which is why modeling a few different outcomes is so critical. You need to think about a range of possibilities, from a decent acquisition to a massive IPO.

Actionable Insight: Create a simple spreadsheet with three columns: "Conservative Exit," "Strong Exit," and "Unicorn Exit." This forces you to think about the full spectrum of potential outcomes and frames your negotiation around realistic upside, not just a single number.

Let's stick with our Series A example and project the future value of your 0.2% stake (20,000 options / 10,000,000 shares) at a few different exit valuations.

Suddenly, that equity grant feels a lot more real. This simple modeling transforms your grant from a static number into a dynamic asset with serious potential. To really nail this, it helps to understand how to value a company from an investor's perspective.

These quick calculations give you a much clearer picture of what's on the table, but we’re not done yet. We still need to account for one of the most important (and often overlooked) factors: dilution.

Here’s a critical variable many candidates forget: future dilution. Every time the company raises more money, it issues new shares, which means your slice of the pie gets a little bit smaller. Ignoring this is a common and costly mistake.

To build a more accurate picture, let's create a simple table to model how dilution might impact your grant. We'll assume a standard 25% dilution from a future funding round, which would reduce your 0.2% stake to 0.15%.

As you can see, dilution takes a real bite out of your potential payout. It’s not something to be ignored.

When you're modeling your own scenarios, it's wise to apply a dilution discount. A conservative but realistic estimate is to assume your stake will be diluted by 20-25% with each future funding round.

Applying this thinking to our "strong acquisition" scenario reduces a $1,000,000 potential payout to a more realistic $750,000-$800,000. This kind of preparation gives you the data you need to walk into a negotiation feeling informed and confident, not just hopeful.

All your research and valuation work boils down to this moment: the actual conversation where you negotiate your stock options. Knowing what to say—and when—can be the difference between a polite "no" and a seriously improved offer. This isn't about making demands. It's about presenting a thoughtful, data-backed case in a way that feels collaborative.

The right phrasing turns a simple ask into a professional dialogue about fair market value. You want to frame the discussion as a mutual effort to land on a compensation package that reflects your skills, the role's impact, and what the market is paying.

Timing is everything. Please, don't jump the gun and bring up equity during your first interview.

The ideal moment comes after you have a written offer in hand but before you've formally accepted it. At this point, the company has already invested a ton of time in you and decided you're their top choice. That gives you the most leverage.

Once the offer lands in your inbox, take a day or two to review it against your research. This shows you're thoughtful and serious, not just reactive. When you’re ready to talk, schedule a call instead of trying to negotiate the whole thing over email. A call allows for a more human, back-and-forth conversation. Email is best saved for summarizing what you discussed and putting your counteroffer in writing.

Actionable Insight: A well-timed, data-supported conversation is far more effective than an immediate, emotional reaction. Start your call by saying: "I'm incredibly excited about the offer and the opportunity. I've had some time to review the details and wanted to discuss a few components to ensure we're fully aligned." This sets a collaborative, positive tone.

On the call, your tone should be enthusiastic and collaborative. You're not trying to win a battle; you're trying to build a partnership. Kick things off by reiterating how excited you are about the role and the company's mission.

Here’s a script you can adapt when asking for a larger grant:

"Thank you again for the offer. I'm thrilled about the possibility of joining the team and contributing to [Company Mission/Product]. After reviewing the compensation package and comparing it with market data for similar Series A roles in San Francisco from sources like Levels.fyi, the equity portion seems to be a bit below the typical range of 0.2% to 0.3% for a Senior Product Manager. Given my experience in [mention a key skill or achievement, like "launching three major product features last year"], I was hoping we could get the grant closer to that benchmark. Would it be possible to increase the option grant to [Your Target Number] shares?"

This approach just works. Here's why:

After your call, it's always a good idea to follow up with an email that recaps your conversation and formalizes your request. This creates a clear paper trail and makes sure everyone is on the same page.

Here’s a template you can modify:

Subject: Following up on our conversation - [Your Name]

Hi [Hiring Manager's Name],

It was great speaking with you earlier today. I’m even more excited about the opportunity to join as [Job Title] and help drive [Company Goal].

As we discussed, I've done some research on compensation for this role at companies at a similar stage. Based on my findings and my experience in [mention your specific value, e.g., scaling engineering teams], I believe an adjustment to the equity portion of the offer would better align with the market and the impact I plan to have.

To recap, I would be thrilled to sign immediately if we could adjust the initial grant to [Number of Options] options.

Thank you again for your time and consideration. I'm confident we can find a package that works for both of us and am eager to move forward. If you're ready to proceed, I'm happy to review our guide on how to accept a job offer.

Best,

[Your Name]

This email is polite, firm, and professional. It reinforces your enthusiasm while clearly stating your data-backed request, setting the stage for a positive final outcome.

A great negotiation goes far beyond just asking for more shares. The savviest candidates I've worked with know the real value—and security—is buried in the fine print. These advanced levers can protect your equity from being wiped out and potentially save you a fortune in taxes.

Think of it this way: the number of options is the headline, but the terms below are the actual story. Focusing on these details is what separates a good negotiator from a great one. They might seem small, but in an exit scenario, they can be worth far more than a slightly larger grant.

An acquisition sounds like the ultimate win, but it can be the exact moment your unvested equity simply vanishes. This is where acceleration clauses become your most important insurance policy. They dictate what happens to your unvested options when the company gets sold.

There are two main types you need to know:

Actionable Insight: If you're a senior hire, negotiating for at least double-trigger acceleration is a reasonable and crucial ask. You can say, "Since I'm leaving a stable role to join, having double-trigger acceleration would provide important security and ensure I'm protected in an acquisition scenario."

One of the most powerful, and least understood, negotiation points is the right to early exercise. This provision is a game-changer, allowing you to purchase your stock options before they have vested. It’s a strategic move that can create massive tax advantages down the road.

When you early exercise, you're buying the shares at their current fair market value (your strike price). If you do this right after the grant is issued, the value of the shares is often equal to your strike price. This means the taxable "bargain element"—the spread between the strike price and the fair market value—is zero.

This simple action, combined with filing an 83(b) election with the IRS within 30 days, starts the clock on your long-term capital gains holding period.

Actionable Insight: An 83(b) election tells the IRS you want to be taxed on the value of your stock today, even though it's not vested. When the value is minimal, so is the tax. This move can transform a future tax bill from a staggering ordinary income rate (up to 37%) to a much more favorable long-term capital gains rate (typically 15-20%). The 30-day deadline is strict, so set a calendar reminder.

This strategy is especially powerful at very early-stage companies where the strike price is incredibly low. You are taking on risk—you're buying shares that could end up worthless—but the potential tax savings can be enormous.

The standard post-termination exercise period (PTEP) is a ticking clock that forces a painful decision when you leave a company. Most startups give you just 90 days after your last day to decide whether to purchase your vested stock options.

This creates a serious dilemma known as the "golden handcuffs." You might have vested options worth a significant amount on paper, but you need thousands of dollars in cash to exercise them, plus enough to cover the potential tax bill. Many employees are forced to walk away from their hard-earned equity simply because they can't afford to buy it in that short window.

This is why negotiating a longer PTEP is a critical safety net. Pushing for an extension from 90 days to one, five, or even ten years gives you invaluable flexibility. That extra time lets you see if the company gains traction or heads toward an exit before you have to commit your own capital.

This request is becoming more common and shows you're thinking strategically. The data backs it up: informed candidates who push for clauses like these come out way ahead. Negotiating for early exercise and filing an 83(b) election has, in many tech exits, saved employees an average of $180K in taxes. You can discover more about option data and historical trends on OptionMetrics.com. Pushing for these terms ensures you're prepared to reap the full rewards of your work.

Even with the best prep, you're bound to hit a few tricky spots when it comes time to talk numbers. Let's walk through some of the most common questions and sticking points that come up, so you can handle them with confidence.

This is a classic pushback, especially at later-stage startups that have more rigid compensation bands. But "non-negotiable" rarely means the conversation is completely off the table.

When a company won't budge on the number of options, it's time to pivot. Instead of getting stuck on the grant size, you can shift the conversation to other parts of the equity package that are often more flexible. Your goal is to turn a potential dead end into a creative problem-solving session.

Here are a few other levers you can pull:

This approach shows you're being a reasonable collaborator while still making sure you're properly valued.

Whatever you do, don't just pull a number out of thin air. Your request needs to be anchored in solid data, not just a gut feeling. The most effective way to frame your ask is by using that ownership percentage you calculated earlier.

This is where your research from platforms like Levels.fyi really pays off. For example, say you're a senior engineer interviewing at a Series A company and their 0.1% offer falls short of the 0.15% - 0.25% market range you've identified. Now you have a specific, data-backed reason for your counteroffer.

Actionable Insight: A much more powerful approach is to frame your ask around market alignment, not personal desire. Saying, "Based on the data I've seen, a grant closer to 0.2% is more typical for this role and stage," beats "I was hoping for more" every single time. It depersonalizes the request and focuses on objective facts.

As a general rule of thumb, a reasonable counter is typically 10-30% above the initial offer, as long as it aligns with the market data you’ve gathered. This data-driven approach positions you as a well-informed professional, not someone just trying to get more.

Ah, the classic cash-versus-upside dilemma. There’s no single right answer here—it all comes down to your personal financial situation and how much risk you’re comfortable with.

Think through these factors to find your answer:

Practical Example: A candidate with a young family might negotiate for a $10k salary increase instead of an extra 0.05% in equity to cover daycare costs. Another candidate living with roommates might do the opposite, trading a lower salary for a larger equity stake with a higher potential payoff.

Finally, you have to know what warning signs to look out for. Certain red flags can signal an unfavorable offer or, worse, a lack of transparency from the company.

Keep your eyes peeled for these issues:

Spotting these red flags early helps you avoid potentially messy situations and ensures you’re joining a company that operates with transparency.

Stock options give you the right to buy a set number of company shares at a fixed price in the future. They are a key part of startup compensation, offering significant potential upside if the company grows in value. Negotiating them is crucial because a small difference in the number of options or the terms can translate into a large financial difference years later.

The best time to negotiate stock options is after you have received the initial written offer and have discussed base salary. Once salary is agreed upon, you can say, "I'm excited about the offer. I'd like to discuss the equity component to better understand the full package." This frames it as part of the total compensation discussion, not a separate demand.

You must understand four key terms: the exercise price (strike price), the vesting schedule (typically 4 years), the cliff (often 1 year), and the company's latest 409A valuation (which sets the fair market value of shares). You should also ask about the total number of fully diluted shares to understand what percentage of the company your grant represents.

It's difficult to compare raw numbers across companies. Instead, ask for the percentage of the company your grant represents (e.g., 0.1%). This is the most meaningful metric. You can also research typical equity ranges for your role, experience level, and the company's stage (e.g., Seed, Series B) using resources like startup salary/equity surveys.

Absolutely. This is a common and strategic trade-off. You can say, "I understand the budget for base salary. Given my commitment to the company's long-term success, would you be open to increasing the equity grant to help balance the total compensation?" This positions you as invested in the company's growth.

Beyond the basics, ask: "What is the post-termination exercise window?" (The time you have to buy your shares after leaving), "Are there any special tax provisions like an early exercise option?", and "What is the company's current valuation and the price per share of the most recent funding round?" This shows you're doing serious due diligence.

As an employee, you typically cannot negotiate the exercise price, as it is set by the company's most recent 409A valuation to comply with tax laws. Therefore, your negotiation should focus primarily on increasing the number of options you receive, which directly increases your potential upside.

Ready to find a startup that values your talent and offers a compelling equity package? On Underdog.io, you can connect with hundreds of vetted, high-growth companies. Create your profile in 60 seconds and let top startups come to you.