When you see a job posting for a product manager, the salary is just the starting point. In the United States, a mid-level PM can expect a base salary somewhere between $101,000 and over $158,000. Senior roles, naturally, pull in quite a bit more.

But that base pay is only one piece of the puzzle. Especially at a startup, your actual earnings are a mix of that guaranteed salary, performance bonuses, and a slice of company ownership in the form of equity.

Looking at a startup job offer for the first time can feel a little overwhelming. It's often packed with jargon like vesting schedules, strike prices, and performance targets that you won't see in a corporate offer letter. The number listed under "salary" is the easy part—it’s the rest of the package that requires a closer look to understand your real earning potential.

To compare opportunities accurately, you have to look beyond that single number and learn to decode what's really on the table.

Think of your compensation like a three-legged stool: base salary, cash bonus, and equity. If any one of these legs is weak or missing, the whole thing gets wobbly. Each one plays a unique and important role in your overall financial picture.

Your total package is a blend of immediate, guaranteed cash and long-term, high-upside potential. Getting a handle on how these components work together is the first step toward making a career move you’ll be happy with down the road.

Here’s a practical breakdown of what you’ll typically see:

A common mistake is focusing too much on the base salary. An offer with a slightly lower base at a fast-growing startup could end up being far more lucrative in the long run than a higher salary at a company that’s plateaued.

Demand for great product managers has been booming, especially in tech hubs across the United States. Today, base salaries for mid-level roles generally fall between $101,000 and $158,000 a year, with senior PMs commanding anywhere from $122,000 to $190,000.

This combination of salary, bonus, and equity makes up your complete financial offer. To really dig into all the details beyond base pay, check out this straightforward guide on what is a total compensation package. Making sure you see the full picture is absolutely critical before you even think about accepting an offer or starting a negotiation.

Joining a startup isn't one single experience. The company you join on day one—scrappy, fast-moving, and running lean—is a world away from the one it will become after raising millions in venture capital. This evolution directly shapes the product manager salary you can expect.

It all comes down to a classic trade-off between risk and reward. Understanding this dynamic is key to figuring out where you fit in. Before you even apply, you can get a feel for whether an opportunity leans toward a smaller salary with a massive slice of potential ownership, or a more stable paycheck with less equity upside.

Seed-stage companies are the newborns of the startup world. They’re often running on fumes and initial cash from founders or angel investors, desperately trying to find product-market fit with a tiny team. Cash is king, and every dollar is stretched to its limit.

Because of this, base salaries here are the lowest you'll find. A PM joining at this stage can expect a salary that’s 15-30% below the market average for their experience level. To make up for the lower cash, the company offers a much juicier equity grant. This is the ultimate bet on the future.

For perspective, a mid-level PM who might normally command $150,000 at a bigger company could be offered $115,000 in base pay, but also receive an equity grant worth 0.5% to 1.0% of the entire company.

Once a startup raises a Series A round, it means they've proven something. There’s a real idea, some early customer love, and a believable path to growth. With millions in the bank, the company can finally afford to compete for talent. The goal shifts to attracting proven players without giving away the farm like they did in the seed stage.

Your compensation package at a Series A company starts to look more balanced. The base salary will be much closer to the market rate, but the equity grant will naturally be smaller than what the first few employees received. The company has been de-risked, and your compensation reflects that.

At the Series A stage, the company is professionalizing. They are building repeatable processes and scaling the team. Your offer will reflect this shift from pure potential to proven traction, blending a solid salary with meaningful equity upside.

By the time a startup hits Series B, it's a well-oiled machine on a steep growth curve. It has a proven business model and is laser-focused on capturing more market share. At this point, compensation packages become highly competitive and start looking a lot like what you'd see at larger, public tech companies.

Base salaries are often at or even above the market average. Structured cash bonuses become more common. And while you'll still get equity, the grant will be a much smaller percentage. It’s not that it’s worth less—in fact, the dollar value can be huge—but the company's valuation is so much higher that your slice of the pie is proportionally smaller.

Here’s a quick breakdown of how the trade-off evolves:

Ultimately, choosing the right stage comes down to you. If you’re financially stable and fired up by the idea of building something from nothing, a seed-stage role offers an unmatched opportunity. But if you prefer a more established product and a bit more stability while still riding the growth wave, Series A or B might be your perfect fit.

In a world where you can join a team meeting from a coffee shop in Austin or a home office in Atlanta, it’s easy to think your physical address is irrelevant. While the explosion of remote work has certainly changed the game, for product managers, geography still has a massive impact on your paycheck.

Where you live—or where your company is based—remains one of the biggest levers on your earning potential.

Major tech hubs like San Francisco and New York City basically operate in their own economic bubble. The sheer density of venture capital, high-growth startups, and established tech giants creates a hyper-competitive market for top talent. This fierce competition for the best product minds directly inflates salaries as companies battle to attract and keep them.

Living and working in a top-tier tech city comes with a significant salary premium. Companies in these areas have to anchor their compensation bands to the high local cost of living and, more importantly, the intense fight for talent. This creates a noticeable gap between what a PM earns in a major hub versus pretty much anywhere else.

For example, a product manager in San Francisco can expect an average base salary around $132,367, while their counterpart in New York City averages $105,696. This is a stark contrast to the national average, showcasing just how much of a financial leg up you can get by targeting roles in these key markets. PMs in San Francisco, for instance, can earn nearly 25% more than their peers elsewhere in the country, a difference fueled by the constant flood of venture funding. You can find more insights on how geography influences product manager pay and what it means for your career.

This premium exists because a startup in the Bay Area isn't just competing with other startups; they're also up against Google and Meta for talent. As a result, they have to offer packages that can keep them in the running, which pulls the entire market upward.

To put this in perspective, here's a look at how base salaries for a mid-level PM can vary across different tech hubs.

As the data shows, the premium for being in a top-tier market is very real. Even well-paid remote roles often can't match the upper salary bands you'll find in places like the Bay Area or NYC.

The shift to remote work hasn't created a single, flat salary market. Not even close. Instead, most companies have adopted tiered compensation models that are still tied to geography. They group locations into different "zones" or "tiers," usually based on a blend of cost of living and local salary data.

Here’s what that looks like in practice:

This tiered approach lets startups hire talent from anywhere while keeping their budget in check. For candidates, it means your earning potential is still welded to your zip code, even if your entire team is spread across the country.

So, what's the right move for you? It's the classic trade-off: higher earning potential versus a lower cost of living. A $180,000 salary in San Francisco sounds amazing, but after you factor in rent, taxes, and daily expenses, your disposable income could actually be lower than what you'd have with a $150,000 salary in a city like Denver.

To make an informed choice, you have to look at the whole picture. Use a cost-of-living calculator to compare your target cities. For example, you could find that a $150,000 salary in Austin provides the same purchasing power as a $185,000 salary in San Francisco. This simple exercise can reveal whether the salary premium of a major hub actually translates into real financial gain for your lifestyle.

Ultimately, the best location is the one that aligns with both your career ambitions and your personal financial goals.

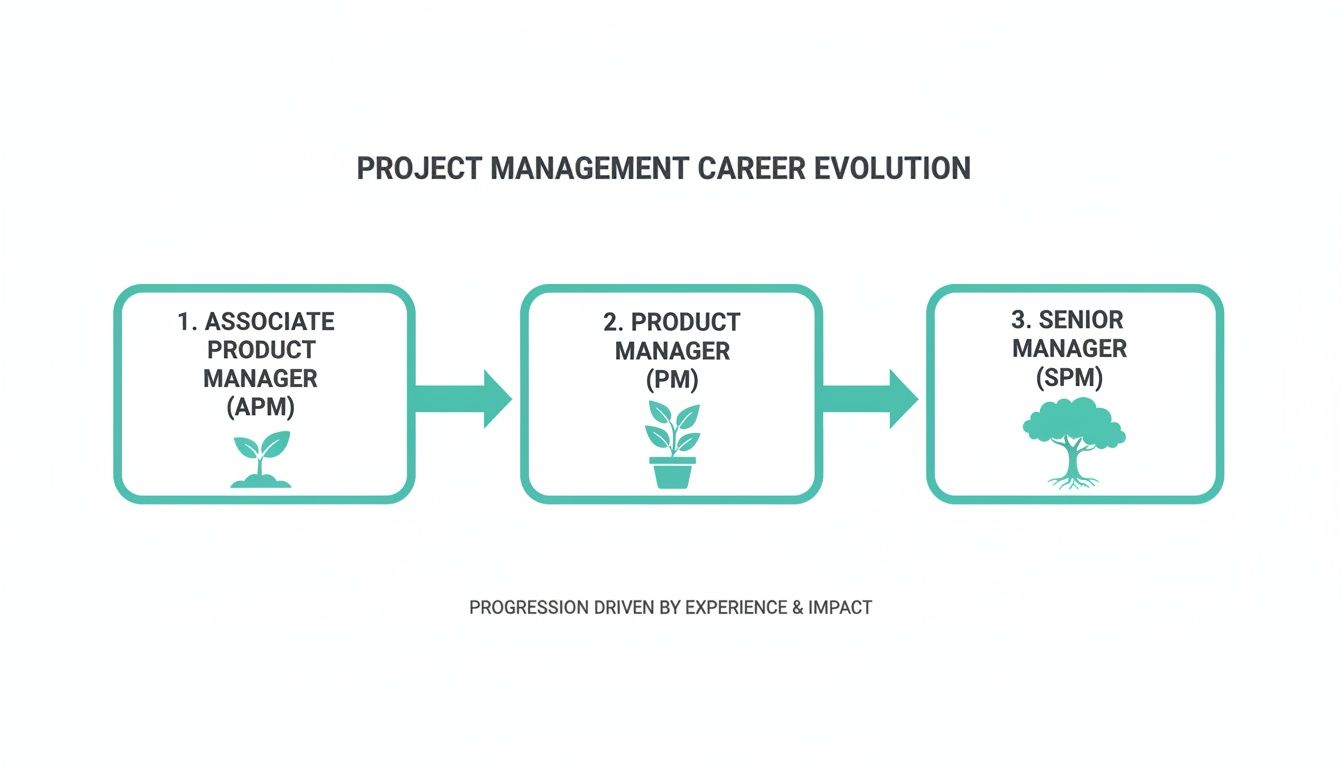

Your job title does a lot more than just tell people what you do—it's a massive signal for your earning potential. As you move up the product management ladder, every step up means a big change in what you’re responsible for, how much strategic impact you have, and, naturally, how much you get paid.

Getting a handle on this progression is key. It helps you figure out if you're being paid fairly today and map out a realistic financial path for your future. The journey from an entry-level role to a leadership spot is a classic trade-off: early on, you’re all about execution and learning the ropes. As you get more senior, it becomes less about pushing pixels and more about managing people, product lines, and the bottom line. This shift is mirrored directly in your compensation.

Let's break down what that looks like.

The APM role is your foot in the door. It’s usually for recent grads or people switching careers, and the whole point is to learn how product management actually works. APMs are almost always paired with a more senior PM, helping out with specific features, digging into user research, and writing up specs.

Given the entry-level nature of the role, the pay is modest. The package is mostly base salary, with a small bonus and very little equity, if any.

After a year or two of grinding it out, an APM usually gets promoted to Product Manager. This is where you get real, meaningful ownership. A PM is on the hook for the success of an entire product or a major feature area, defining the "what" and "why" for their engineering team.

Your pay package gets a lot more interesting here. The base salary jumps up nicely, and the equity grant starts to become a real part of your total compensation. This reflects the fact that you now have a direct impact on whether the product sinks or swims.

At the PM level, you're not just taking orders anymore—you're setting the direction. Your ability to get your team aligned, prioritize ruthlessly, and ship stuff that actually moves the needle is what makes you valuable. That's what your salary is based on.

Making the leap to Senior Product Manager is less about ownership and more about influence. SPMs are thrown at the gnarliest, most ambiguous problems—the kind that cut across multiple teams or even entire product lines. They’re also expected to start mentoring other PMs and help shape the bigger-picture product strategy.

The compensation reflects this added weight. The base salary for an SPM often picks up where the mid-level PM range leaves off, usually landing between $122,000 and $190,000. Your bonus and equity also get a serious boost, because your decisions now have a much wider blast radius.

At the top of the startup product food chain is the Head of Product. At this point, your day-to-day is almost entirely disconnected from individual features. It’s all about strategy, people, and process. You’re building and leading the entire product org, setting the long-term vision, and making sure the product roadmap actually supports the company's business goals. You can see a more detailed look at how these roles evolve in our guide to the product manager career path.

The pay structure changes dramatically at this level. The base salary is high, of course, but a huge chunk of your earnings will come from performance bonuses tied to company-wide goals and a very significant equity stake that reflects your executive status.

To put it all together, here’s a snapshot of how compensation tends to evolve as you climb the ladder at a startup.

As you can see, the base salary grows steadily, but the real wealth-building potential comes from the equity component, which skyrockets as you take on more strategic responsibility for the company's success.

Alright, let's talk about the most exciting—and easily the most confusing—part of a startup offer: equity. Unlike your base salary, it's not a number you can immediately take to the bank. Think of it more like a high-potential lottery ticket. To figure out what it could actually be worth, you need to look past the big grant number and do some back-of-the-napkin math.

Your equity grant usually comes in the form of stock options. These aren't shares themselves, but rather the right to buy a certain number of shares down the road at a fixed price. This is called the strike price (or exercise price), and it’s typically set at whatever the company’s fair market value is on the day you get your offer.

As you climb the ladder in product, the equity piece of your compensation becomes much more significant. More strategic impact almost always comes with a bigger stake in the company's success.

To get a real sense of your equity's potential, you need to focus on three things: the number of options, your strike price, and the vesting schedule.

Let's make this real with an example.

Example Scenario

You’ve been offered 20,000 stock options. The startup is currently valued at $10 million and has 10 million total shares. This pegs your strike price at a neat $1.00 per share. You’re on that standard four-year vesting plan with a one-year cliff.

Here's the thing about options: their value is entirely tied to the company's future growth. If the company’s share price never climbs above your $1.00 strike price, your options are basically worthless ("underwater," in startup lingo). But if the company takes off, your upside can be massive.

Let's imagine you stick around for four years and are fully vested. What could happen?

This is the incredible leverage of equity. Your purchase price is locked in on day one. Every dollar the share price climbs from there is pure profit.

Of course, this is a simplified look. You also need to understand things like what is equity dilution, which can impact your total ownership stake over time. And when you do eventually sell, taxes become a huge factor. Getting smart about the difference between Short Term vs Long Term Capital Gains can save you a serious amount of money.

Getting a job offer isn't the finish line—it's the start of a crucial conversation. Once you have a handle on the market and know your value, you can confidently negotiate a package that truly reflects the impact you're about to make. The trick is to treat it like a collaborative discussion, not a battle.

Remember why a startup is hiring you in the first place: to solve expensive problems. When you frame your value around the business outcomes you can drive, your arguments become much more compelling than just throwing out a number. Make sure you've done your homework and come prepared with data on typical PM salaries for a company of their stage, location, and your experience level.

The best negotiation begins long before an offer ever hits your inbox. Throughout the interview process, zero in on the company's biggest headaches and explain exactly how your skills are the solution. This builds your leverage and gives you a rock-solid foundation for your eventual ask.

If you can help it, never be the first person to state a number. When they pop the dreaded "salary expectations" question early on, a great way to respond is: "I’m really focused on finding the right fit, and I’m confident we can land on a fair number if we both feel it’s a match. Could you share the approved range for this role?"

This simple move puts the ball in their court and instantly gives you a data point to work with. Once they provide a range, always anchor your conversation toward the top end. If they offer $140,000 on a $130,000-$150,000 band, your counteroffer should start above $150,000, not just a little bump over their initial number.

Not all compensation is created equal. What you choose to prioritize really depends on your personal finances and how much risk you're comfortable with.

A popular strategy is to ask for a modest bump in base salary while being more assertive about getting more equity. This signals that you're literally invested in the company's future, a message that often lands well with founders.

Having a few phrases in your back pocket can make the whole conversation feel less intimidating and a lot smoother.

Negotiation is a totally normal and expected part of hiring. As long as you stay professional, back up your requests with data, and keep reinforcing your excitement for the role, you can advocate for yourself effectively and walk away with the best possible offer.

Jumping into the world of startup compensation can feel like learning a new language. Even after you've got the basics down, some of the finer points can be confusing. Let's tackle some of the most common questions that pop up when product managers are weighing their options.

It's true that you'll likely see a lower base salary when moving from a FAANG-level company to an early-stage startup, but don't brace for a massive drop. A 10-20% decrease in your base pay is a realistic expectation.

The key, however, is that this dip should be more than made up for by a much larger equity grant. You have to look at the entire package. A startup that's serious about talent will structure an offer where the potential upside from your equity makes taking a temporary hit on cash feel like a smart long-term bet.

This one comes down to your personal finances and how much risk you're comfortable with. There’s no single right answer. If you need more cash flow for your mortgage, student loans, or just plain old peace of mind, pushing for a higher base salary is the sensible move.

If you’re in a good place financially and you’re a true believer in the company’s mission, negotiating for more equity could genuinely change your life down the line. Most candidates I see try to find a middle ground—they’ll ask for a small bump in salary to feel comfortable and a more significant increase in their equity stake.

They absolutely do. If you're a PM with deep expertise in a hot field like AI, FinTech, or HealthTech, you can often command a salary premium. We're talking anywhere from 15-25% more than a generalist PM at the same level.

This bump comes from simple supply and demand. There just aren't that many people who have both top-notch product skills and legitimate domain expertise. If you're looking at one of these roles, just do your homework to make sure the company is truly committed to that specialty and not just chasing a trend.

This is getting easier, thankfully. A great place to start is by looking at companies based in places with pay transparency laws, like New York City or California. They're often required to post salary ranges right in the job description, which takes a lot of the guesswork out of the process.

You can also use curated hiring platforms where transparency isn't just a buzzword; it's part of how they operate. With modern hiring models, compensation is often one of the first things discussed to make sure everyone's on the same page. It saves you a ton of time and starts the relationship off with a foundation of trust.

Trying to find that perfect startup role that aligns with your career goals and your salary needs can feel like searching for a needle in a haystack. At Underdog.io, we connect talented product managers with hundreds of vetted, high-growth startups in the biggest tech hubs. Stop spamming applications and let the right opportunities find you. Get started with Underdog.io today.